Via DCFPI.

Via DCFPI.

All of Renee Joyner’s paycheck goes toward paying her rent. Anything else she needs for her and her daughter to live—food, toiletries, basic necessities—is paid for, barely, through food stamps and other vouchers. But her entire paycheck? Straight to paying her $917 a month rent.

For the past year, Joyner—a single mother who works as a cosmetologist—has been renting a one bedroom apartment in the Brightwood neighborhood of Northwest D.C. She’s lived in Northwest her whole life. Her family’s house—the house she grew up in—is only seven blocks away. Her grandmother still lives there, but as a single mother, she wants her own place for her and her daughter. But with D.C.’s rising rental costs, that’s becoming impossible.

“I haven’t even been able to spend any money on myself,” she tells DCist. “It all goes to rent.”

But Joyner’s story isn’t unique. She’s a victim of D.C.’s dwindling affordable housing, which, according to a new report from the D.C. Fiscal Policy Institute, has shrunk exponentially over the past decade. In fact, affordable housing has shrunk so much that low-cost private housing has essentially vanished in the District.

“There is virtually no inexpensive housing left in D.C.’s private market,” says Wes Rivers, Policy Analyst at the DC Fiscal Policy Institute, and author of the report, which is an update from a similar 2012 report. “Without housing assistance, many families have no choice but to devote most of their income for rent.”

Which is exactly what Joyner has been forced to do.

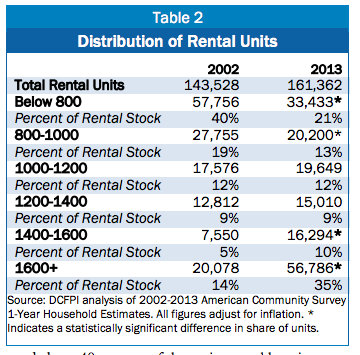

According to the DCFPI’s report, the number of low-cost apartments in D.C. nearly dropped in half between 2002 and 2014. In 2002, the number of apartments where the monthly rent and cost of utilities were below $800 was at 58,000. In 2013? Only 33,000 units.

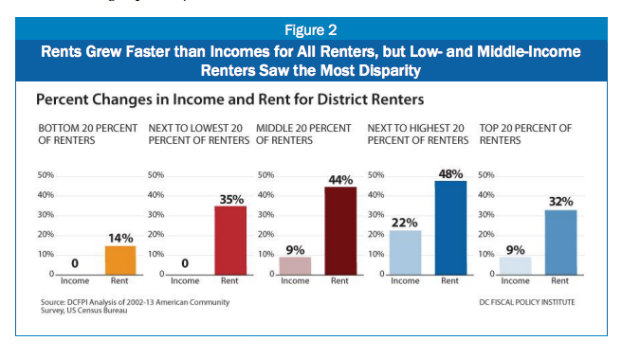

And with rents in D.C. rapidly rising—despite what some reports (which we have posted about) have said—low income households are faced with a devastating dilemma: cut costs on basic necessities like food, transportation, and healthcare to pay for rent; or apply for subsidized housing, which, as DCFPI’s report reveals, is now pretty much the only source of cheap housing in D.C. 64 percent of low-income households devote half of their income or more to rent.

Via DCFPI.

Via DCFPI.

But low-income families aren’t the only ones suffering. The report also found that moderate-income families are also being priced out. According to the data, one-third of households with incomes of up to $54,000 are facing a major housing crisis. Now. As the report reveals, one in four District renters spends more than half of their income on rent and utilities, which makes up about 41,000 people in 2013. Compare that to about 27,000 in 2002 to get a sense of just how much rent has skyrocketed in the past decade.

Affordable housing has a trickled down effect. Spending all of one’s income on rent forces one to cut costs in other areas that drastically hinders the quality of life. As the DCFPI notes, lack of affordable housing also “affects school outcomes:”

A 2012 Urban Institute report notes that “children who experience homelessness or are living in overcrowded, doubled-up situations may lack the necessary tools to do well in school” and that “parents experiencing homelessness or residential instability may not be able to prioritize helping children with their homework or be involved in school activities.”

This is what Joyner fears. She says that, as her daughter grows older, the cost of caring for her is going to go up and she doesn’t know how she’s going to pay for it. She doesn’t want to be forced to move into one of the District’s homeless shelter’s, because “the quality of life there is so poor.” Moreover, she’s lived in Northwest her whole life and doesn’t want to have to search in Northeast, Southeast, or Southwest to be to afford a place to rent.

There are ways to help alleviate the affordable housing crisis, Rivers’ report outlines. One of them is the Housing Production Trust Fund, which would set aside $100 million annually to help support the “construction, rehabilitation, and acquisition of housing for low- and moderate-income residents.” Though the D.C. Council passed legislation last year to ensure money is set aside for the Trust Fund, it has yet to be funded.

Moreover, Rivers says that the District government should develop an effective affordable housing preservation plan and strategy, increase access to housing through the Local Rent Supplement Program, and strengthen the city’s inclusionary zoning program, which secures affordable housing for low- and moderate-income residents in new housing developments.

You can read the full report below: