The $8,000 federal first time homebuyer tax credit expired on Friday, so we’re curious to see where the D.C. housing market goes from here. Anyone with a signed contract as of Friday still has until June 30 to close and claim either the first-time buyer credit or the move-up credit. And of course, that $5,000 D.C. first time homebuyer tax credit is still good even after the federal credit expired.

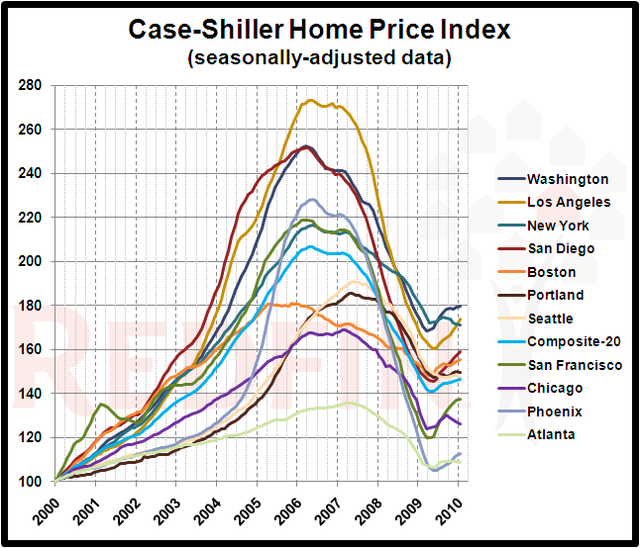

As far as where we are now, the Case Shiller Home Price Index for February was released earlier this week. The 20-city index was positive year-over-year for the first time in three long years. One chart caught my eye, showing the relative strength of D.C. home prices compared to other cities in the index. (Image Courtesy of RedFin)

It’s a little hard to make out, but D.C.’s home prices have held up the best since 2000 of any city in the 20-city index. Los Angeles appears to be in second, and is on a somewhat more upward trajectory, while New York City looks like it’s actually slipping further.

Case Shiller data for february 2010 (released in April.)

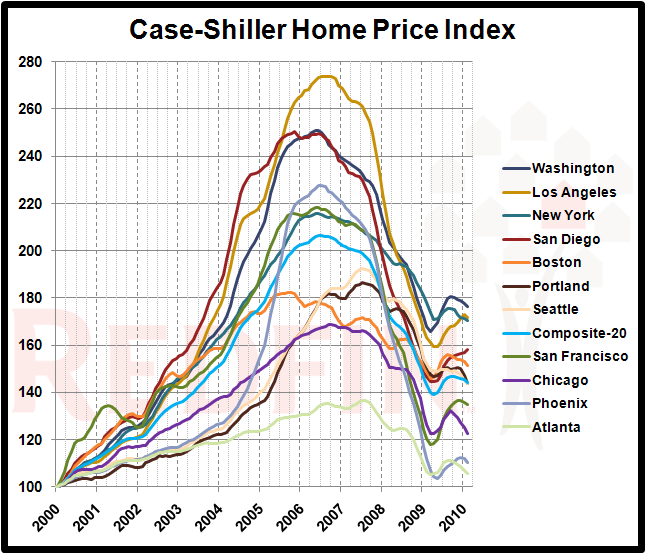

Case Shiller data for february 2010 (released in April.)

On the SweetDigs DC blog, RedFin does several charts tied to the release of the monthly Case Shiller numbers, including one that breaks out the high, mid and low ranges of the D.C. market. According to Redfin, “All three of DC’s tiers took a tumble between January and February, but the low tier was definitely hit the hardest, falling 1.6 percent. The middle tier dropped 0.6 percent, and the high tier fell just 0.2 percent.”