Photo by keviikev.

The Case-Shiller report was released last week, and D.C. was the strongest market of the 20-city index. Home prices were up 0.9 percent from February to March, and up 4.3 percent from last March. That’s compared to the national trend of prices falling 5.1 percent from last year.

That’s not to say that prices in D.C. have been on a steady climb. This was actually the first time in seven months that the index showed D.C. prices on the rise. And it’s not like renting is getting any cheaper.

The Wall Street Journal touched on some of the reasons why home prices in D.C. have been more resilient that other cities in the index.

The District of Columbia and close-in suburbs haven’t experienced as high a rate of foreclosures as other areas, which has allowed pricing to remain more stable. … Perhaps more importantly, economists say, the region continues to both attract and keep those house hunters still missing in many areas: first-time, move-up and downsizing buyers, as opposed to luxury or investment buyers.

Additionally, unemployment in D.C. is one of the lowest of all the major U.S. cities, which is unlikely to change dramatically.

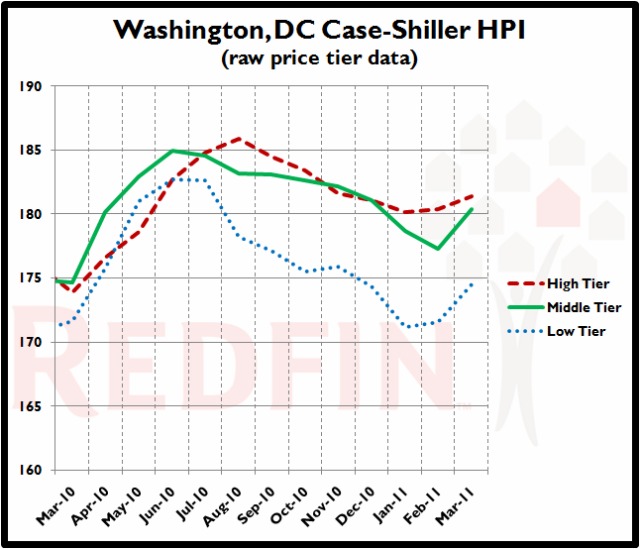

Chart by Redfin.

Chart by Redfin.

This data is actually from March, so prices should continue to rise, peaking in June or July as they normally do. But with higher gas prices and the job market