In D.C., property taxes are based on a city assessment on the value of the home. If you think your home’s value is assessed too high—meaning you’d end up paying higher property taxes—you can appeal. But you’d better have a damn good reason. Like mustard gas.

In D.C., property taxes are based on a city assessment on the value of the home. If you think your home’s value is assessed too high—meaning you’d end up paying higher property taxes—you can appeal. But you’d better have a damn good reason. Like mustard gas.

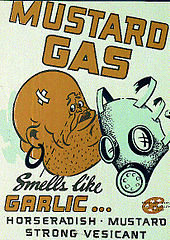

The Washington Business Journal reports today that a D.C. man successfully got the city to knock his home’s assessment down to $3.36 million from $3.54 million, mostly because it stands on ground once used by the U.S. Army to bury mustard gas and arsenic canisters:

The assessment hearing, held last October, focused on the search for mustard gas and arsenic canisters tied to a World War I-era chemical weapons facility. Glenbrook Road is the epicenter of the U.S. Army Corps of Engineers’ two decade-long Spring Valley cleanup.

The commission agreed with Stern, reducing his assessment from $3.54 million to $3.36 million, saving him roughly $1,500 on his annual tax bill. The panel cited in its decision the “extensive press coverage of the munitions situation” and the fact that the five-bedroom, 6,717-square-foot home would “likely sell for less” than its assessed value.

The “subject’s value is likely impaired as a result of this situation,” the three-member commission panel concluded. Stern could not be reached for comment.

Obviously, anyone can appeal—and many try. But unless you can prove that some branch of the armed forces surreptitiously dumped munitions or chemicals on the land where your house was built, you might lose.

Martin Austermuhle

Martin Austermuhle