More than 20 people were arrested today following a multiyear investigation into a scheme to obtain fraudulent Medicaid payments from D.C.’s program, the largest fraud bust of this kind in the city’s history.

This includes one woman who owned three home care agencies, the U.S. Attorney’s Office alleges, but was barred from participating in federal health care programs. Florence Bikundi — whose companies received more than $78 million in payments from Medicaid, including $75 million from D.C.’s program — has been charged with health care fraud, Medicaid fraud and money laundering.

It’s not known yet if any of this money went to people with legitimate Medicaid claims, but the U.S. Attorney’s office suspects a large amount of the billings were fraudulent.

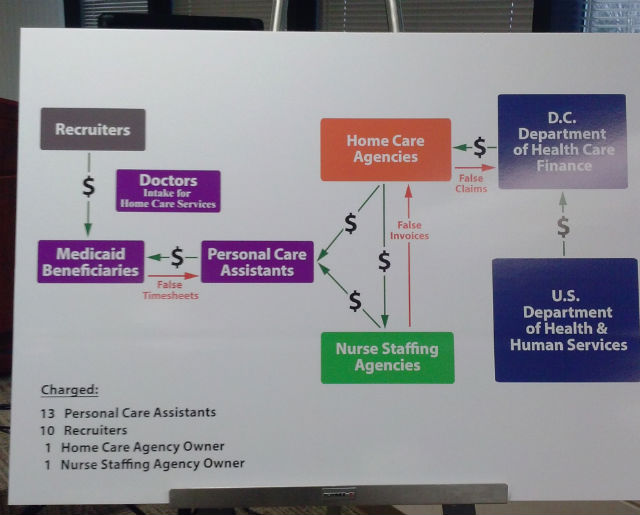

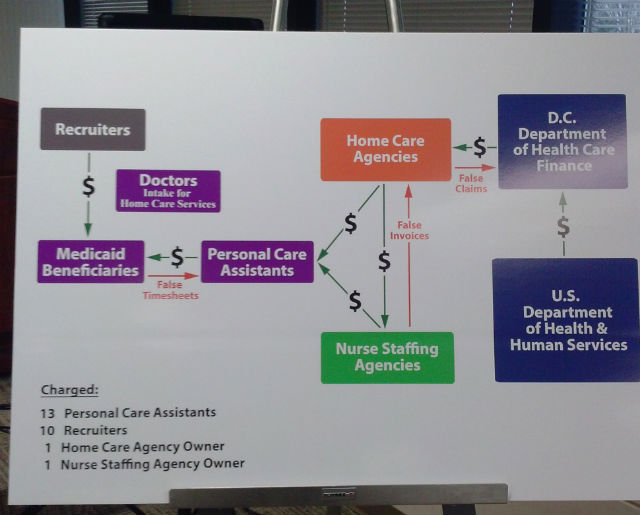

Others are accused of conspiring to get Medicaid payments for personal care services never provided, through a system involving recruiters, personal care assistants, and beneficiaries.

A personal care aide, Adoshia L. Flythe, is accused of selling counterfeit documents — including a certificate from the University of the District of Columbia — to help people become personal care aides, which made them eligible for Medicaid reimbursement.

Ronald C. Machen Jr., the U.S. Attorney for the District of Columbia, said “this sort of healthcare fraud is ultimately motivated by greed,” and that Medicaid fraud in the city is at “epidemic levels.” He said 49 bank accounts have been frozen as a result of the operation, and bank records and property — including Bikundi’s Maryland home and six luxury vehicles — were seized.

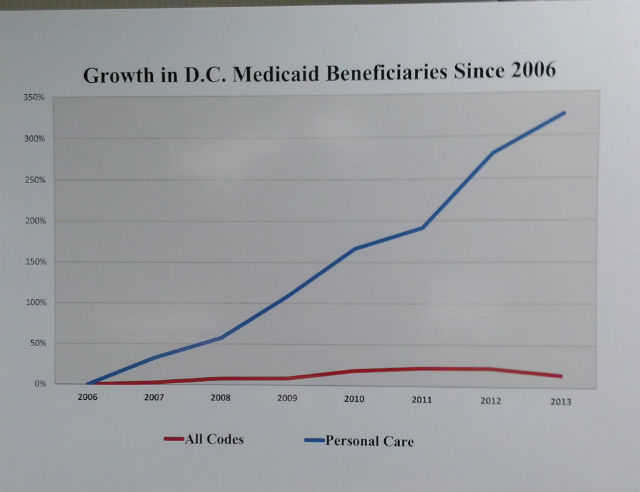

Since 2006, Machen said, there’s been an “explosion” of claims in D.C. Medicaid for home healthcare service, his agency believes, “in large part due to fraud.” In 2006, D.C. Medicaid paid out over $40 million for personal care for around 2,500 beneficiaries. By 2013, that number was $280 million for more than 10,000 beneficiaries. Machen said the investigation was launched to find out who and what was responsible for the growth.

What they found: “Aggressive networks of fraudsters paying kickbacks to beneficiaries to manufacture false claims for nonexistent claims.” When asked if the alleged scheme was sophisticated, Machen said it wasn’t “overly complex.”

“They had it down to a science,” he added.