Via District, Measured.

Via District, Measured.

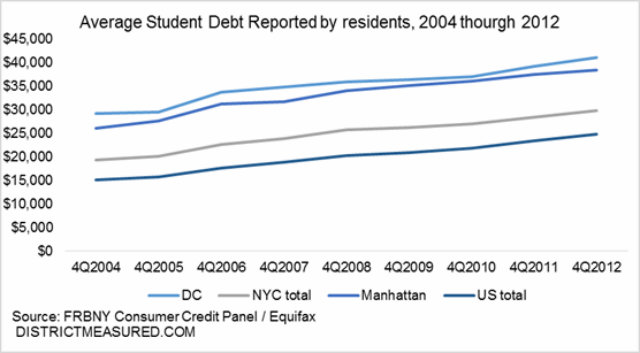

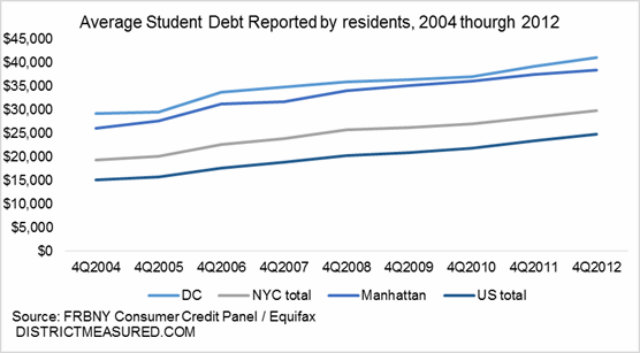

Arbitrary rankings time! But hey, look, this one doesn’t commit the grave sin of comparing D.C. to other states. District, Measured, D.C.’s Office of Revenue Analysis blog, crunched some numbers that paint a portrait of just how much student loan debt District residents have. Spoiler: a lot.

In fact, D.C. has some of the highest student loan balances in the country, District, Measured found. According to data compiled by the Federal Reserve Bank of New York, the average student debt for D.C. residents in 2012 was $41,200. Compare this to the entire national average, which was $16,000 less. And, since everything in D.C. is compared to New York, District, Measured did just that: New York City’s average student debt was $11,000 less.

According to the data pulled, the estimated total stock of loans in D.C. at the end of 2012 was about $5.1 billion, which is up from $2.2. billion in 2004. Of course, D.C. has seen tens of thousands of new, young transplants during that time and a lot of that debt is credited to those new residents. But, as District, Measured says “the total growth in borrowers outpace the population growth, suggesting that some of the increase is due to higher demand for higher education,and rapidly increasing costs, which push more people into borrowing.”

To put this change into perspective, 73,000 residents—or 13 percent of D.C.’s total population—reported student loan balances in 2004. In 2012, 126,000 residents—or one fifth of D.C.’s resident population—reported student loan balances in the District.

Who’s carrying all this debt? Mostly people between the ages of 30 and 40, who, according to data, “accounts for 45 percent of all borrowing in the District,” with an average of $50,000 in student loan debt. Those 30 years-old and younger are “juggling about $37,000 of debt, accounting for 35 percent of total borrowing in D.C.