Roughly 20,000 low-income D.C. residents are not taking advantage of a tax credit that could reap them thousands of dollars every year. It’s called the Earned Income Tax Credit, and many people don’t even know it exists.

The EITC, or EIC, is essentially a subsidy for low-income working families that’s meant to incentivize work and boost purchasing power. In D.C., the refundable credit can be worth as much as $9,000. But Joseph Leitmann-Santa Cruz, associate director of the nonprofit Capital Area Asset Builders, says thousands of eligible District residents aren’t claiming the EITC — and as a result, they’re leaving an estimated $40 million on the table every year.

“There is this general sense that if somebody earns less than $20,500 as a family, or as a married couple, there is no need to report an income form to the IRS — and that is true,” says Leitmann-Santa Cruz. But while many low-income residents don’t owe money to Uncle Sam, he says, “Uncle Sam does owe [them] a lot of money.”

D.C. had the lowest EITC participation rate in the country in the 2014 tax year, according to the latest data available from the IRS. Nationally, the average is 79 percent; in D.C., it was 71.9 percent.

Leitmann-Santa Cruz says that amounts to a major missed opportunity. Some of these working families could be eligible for a federal tax credit of $6,318 each — the maximum in 2017. Plus, D.C. families who receive the federal credit can also claim a 40 percent matching credit from the District, meaning they could see a windfall up to $8,845, either in cash or applied to existing tax liabilities. Eligible childless workers can get a 100 percent matching credit.

But there are barriers to EITC participation, says Leitmann-Santa Cruz. The first issue is education: low-income residents accustomed to not filing taxes may be unaware that filing can get them money in return. Second, people who believe they owe back taxes might steer clear of tax forms, even if they’re eligible for credits. Third, some tax-preparation services charge fees based on the number of tax credits a filer receives. Those charges can add up to hundreds of dollars, discouraging low-income residents from filing.

Plus, taxes are intimidating.

“Anything associated with the tax code is extremely difficult and very complex, so people tend to shy away,” says Leitmann-Santa Cruz.

Yet the EITC is considered one of the most effective anti-poverty public policies in the country. Children in families who receive the EITC and the related Child Tax Credit show improvements in health and academic performance, and they’re more likely to go to college and earn higher incomes as adults, according to the progressive Center on Budget and Policy Priorities.

In the District, childless workers (including workers with grown children) can also benefit from the credit. The federal credit is fairly restrictive — childless workers can’t earn more than $15,010 a year to receive it — but D.C. is more generous, offering a higher income limit and a 100 percent match on the federal credit. The left-leaning Fiscal Policy Institute has shown significant benefits for childless workers in D.C. after the city expanded the credit in 2014.

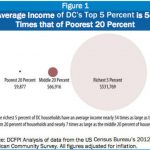

(Source: D.C. Fiscal Policy Institute)

(Source: D.C. Fiscal Policy Institute)

Maryland and Virginia have higher EITC participation rates than D.C. — 77.6 percent and 80.5 percent, respectively, in the 2014 tax year — but many low-income workers in both states still aren’t claiming the federal credit or those offered by state and local governments. Maryland recently passed legislation expanding the state credit to childless workers as young as 18 years old, and Virginia Gov. Ralph Northam has been pushing to make Virginia’s EITC refundable like the federal credit. (It’s currently nonrefundable, meaning if filers’ state credit exceeds their tax liability, they can’t get a refund for the rest.)

Capital Area Asset Builders, which manages D.C.’s official EITC awareness campaign, has recently stepped up efforts to educate the public about the credit. The organization has been visiting communities in wards 8 and 2 to encourage residents to research their eligibility and seek out free tax preparation services.

Many low-income working residents, he says, might be surprised at how much money they can get by filing their taxes.

“The IRS is temporarily holding their money,” Leitmann-Santa Cruz says. “But it always belonged to the working families.”

This story originally appeared on WAMU.

Ally Schweitzer

Ally Schweitzer

(

(