If you’re a federal worker who lives in Southeast Washington, Prince George’s County, or the outer D.C. suburbs, you may be among those government employees most vulnerable to the ongoing government shutdown.

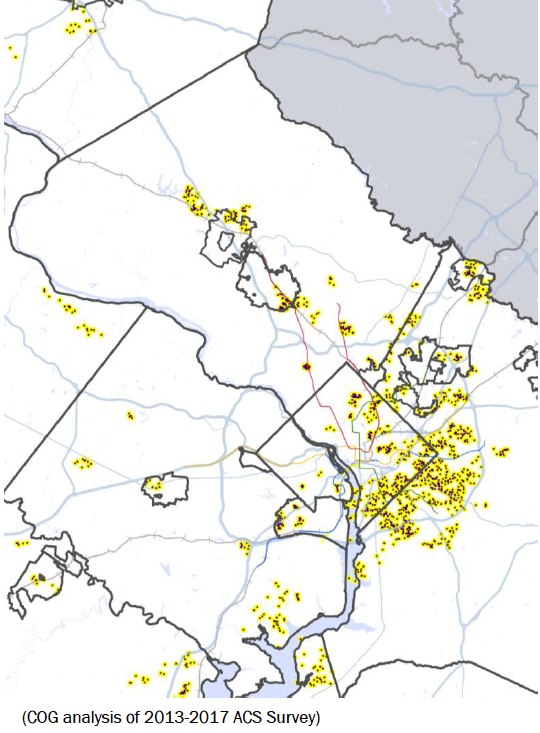

Parts of the Washington region where half of federal workers earn under $75,000.Metropolitan Washington Council of Governments

Half of federal workers in those areas earn less than $75,000 a year, according to the Metropolitan Washington Council of Governments, a nonprofit association that represents regional elected officials.

Analyzing data from the Census’ American Community Survey, MWCOG drilled down on where the lowest-income federal workers live. For the most part, their geographic distribution mirrors overall income distribution in the region: wealth is generally concentrated in the region’s western districts.

Certain local neighborhoods have particularly high shares of lower-income federal workers. According to MWCOG, more than 400 federal employees live in Capitol Heights, Maryland, where the median income for federal workers is $73,857. For the more than 300 feds who live in the Beauregard area of Alexandria, the median income is $66,676.

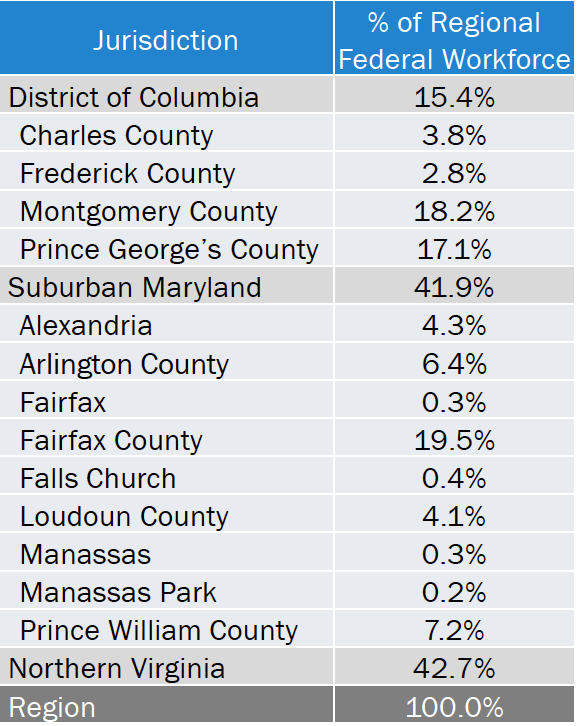

Federal workers are distributed fairly evenly throughout the D.C. region, but Fairfax, Montgomery, and Prince George’s counties account for the largest share. Nearly a fifth of the regional federal workforce lives in Fairfax County, followed closely by Montgomery (18 percent) and Prince George’s (17 percent), per MWCOG. But this data reveals that workers in Fairfax and Montgomery counties tend to earn higher incomes than their equivalents in Prince George’s.

About 360,000 federal workers live in the broader Washington region, and roughly 40 percent of those—or 145,000 workers—have been furloughed since December, according to Stephen Fuller, an economist at George Mason University.

The D.C. region’s federal workforce is spread out across the area, although Fairfax County accounts for the largest share, with 19.5 percent.Metropolitan Washington Council of Governments

Not included in MWCOG’s geographical analysis are business owners and federal contractors who depend on the federal government for their incomes. Some local restaurants have reported significant drops in business, with sales declines averaging 20 percent, according to the Restaurant Association of Metropolitan Washington.

Low-wage federal contractors are hit hardest during a government shutdown, Fuller says.

“The people that tend to get hurt are at the lower end of the wage spectrum or small businesses—people that just don’t have a whole lot of backup or alternatives,” Fuller said in a recent interview.

The shutdown has already prompted many federal workers to file for unemployment and queue up at local food banks. During the last prolonged shutdown in 2013, local claims for unemployment tripled over the previous year, Fuller says.

The broader regional economy is likely to take a hit during the shutdown, too, Fuller says, as consumer spending drops. Sectors such as leisure tourism and business travel are already low this time of year, the economist says, but they could see steeper-than-usual declines the longer the shutdown drags on.

“The longer it takes, the wider the effects are spread across the economy, and it affects—ultimately—consumer confidence,” Fuller told WAMU.

This story originally appeared at WAMU.

Ally Schweitzer

Ally Schweitzer