In increasingly expensive D.C., about twenty percent of residents in Wards 7 and 8 anticipate being unable to afford their home and needing to move in the next three years.

Residents in other parts of the city aren’t immune to intensifying housing pressures, including 12 percent of Ward 5 and 9 percent of Ward 4, who also say they expect they’ll need to move in that time frame because of an inability to pay their landlord or bank. But the sense is greatest in Ward 7 and 8, where 19 and 21 percent of residents, respectively, reported that they are “somewhat likely” or “very likely” to need to find a new home within three years.

That’s according to a new survey that the Office of the Deputy Mayor for Planning and Economic Development released late last month. The study was done in collaboration with The Lab @ DC, a team in the Office of the City Administrator that conducts surveys and research to improve policy-making.

The DC Housing Survey was conducted to supplement research into the need for large rental units in D.C., but it also uncovered more information about housing insecurity more generally, particularly as it breaks down at a ward level.

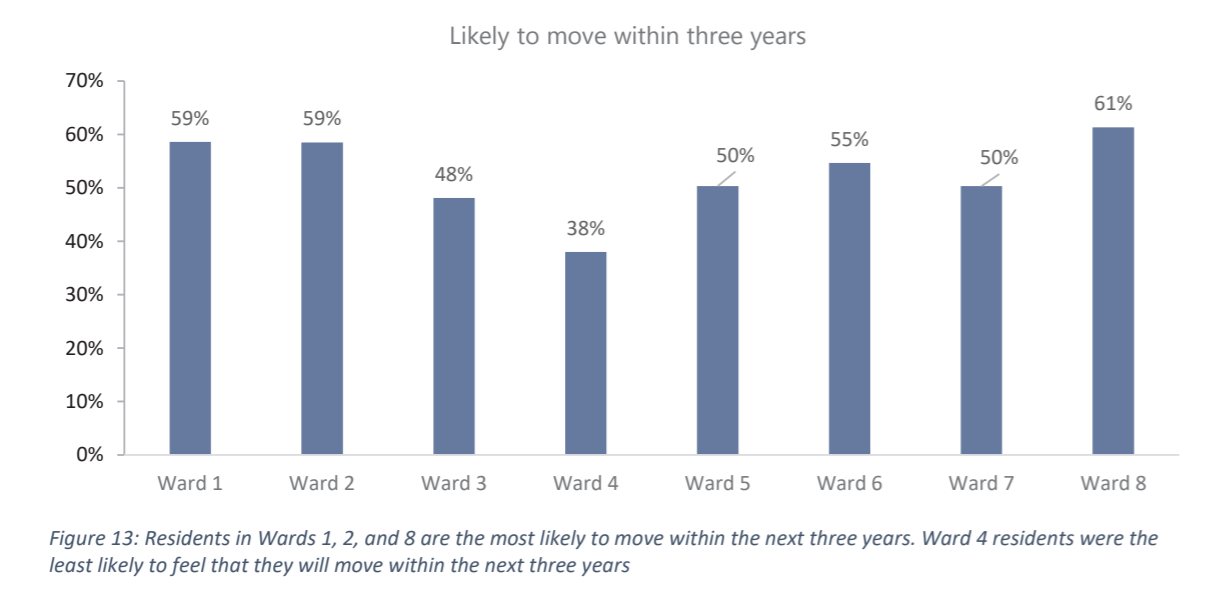

move within the next three years. This chart represents the number of people who answered “somewhat likely” or “very likely.” Courtesy of the Deputy Mayor for Planning and Economic Development

The report classified people as “residentially unstable” if they’ve moved within the last five years in order to lower housing costs and are somewhat or very likely to move within the next three years for those same reasons.

Ward 8 had the highest level of residential instability at twelve percent, followed by eight percent of Ward 7 and seven percent of Ward 6.

The authors note that “residential instability is associated with increased stress and health problems, poorer educational outcomes, decreased community efficacy, and other critical problems for households and communities alike.”

Across the city, black Washingtonians are three times more likely to have last moved due to an inability to pay their bank or landlord when compared to white residents.

The report also sheds light on just how many Washingtonians believe they’ll move, for any reason. A majority of people in every ward, except 3 and 4, said they are likely to move over the next three years.

The reasons that residents said were “important” or “very important” varied by ward, with those in wards 7 and 8 citing safety, better housing conditions, and proximity to grocery stores as significantly higher rates than much of the rest of the city. But the desire for more space is much more uniformly felt across the city (residents of wards 3 and 4 were at the lower end of the spectrum).

There has been persistent criticism that the city doesn’t have enough affordable units to accommodate families, and that newly built housing don’t have enough (or any) three-, four-, and five-bedroom units.

Over one-third of low-income households in D.C. have a bedroom shortage, according to the survey. And the authors note that two significant population was not captured in the survey—people experiencing homelessness and Washingtonians who have already left the city due to rising housing costs and now live in Maryland, Virginia, or elsewhere.

“Affordable family-sized units will need to be a part of [the Mayor’s] plan” to create 26,000 housing units by 2025,” DMPED deputy communications director Kathryn Hartig told DCist via email. “Despite the District’s significant supply of family-sized units, there is strong competition for them, which makes it harder for large, low-income families to find adequately-sized housing they can afford.”

The study supplements an assessment of the city’s need for large units. That report, which was prepared by the Urban Institute and the Coalition for Nonprofit Housing & Economic Development, found that there are more than 100,000 units with three or more bedrooms—one third of the city’s housing stock. But more than three quarters of them are owner-occupied homes, most of which are out of reach for low-income families.

There are about 11,600 large renter households (four or more people) that make less than 50 percent of the area median income, according to the report. Two-thirds are considered cost-burdened, meaning they spend more than 30 percent of income on rent, more than one-third are “under housed,” meaning more than one person per bedroom.

In total, there are only 5,000 units with three or more bedrooms that are subsidized by the three largest federal housing programs (that could drop even further if a proposal to remove 10 buildings from federal control is approved) or D.C.’s inclusionary zoning program.

And the report found the city would need an additional 2,500 highly affordable units to meet the number of large renter households at 30 percent of the area median income.