D.C. Mayor Muriel Bowser’s administration has set yet another ambitious housing goal: 20,000 new Black homeowners by 2030.

At the start of her second term, Bowser announced a 2025 goal of creating 36,000 new housing units, 12,000 of which would be affordable. Her administration says the city is roughly halfway through meeting the targets, creating just over 25,600 total units with 6,000 of them below market rate. On Monday, Bowser (who is in the midst of running for a third term) took things a step further and announced that she has accepted her Black ownership strike force’s recommendation of working to create 20,000 new Black homeowners citywide by 2030.

“We know that we want to add more homes,” said Bowser at an event at Howard Theater. “But we also want to be intentional about making sure more people can afford those.”

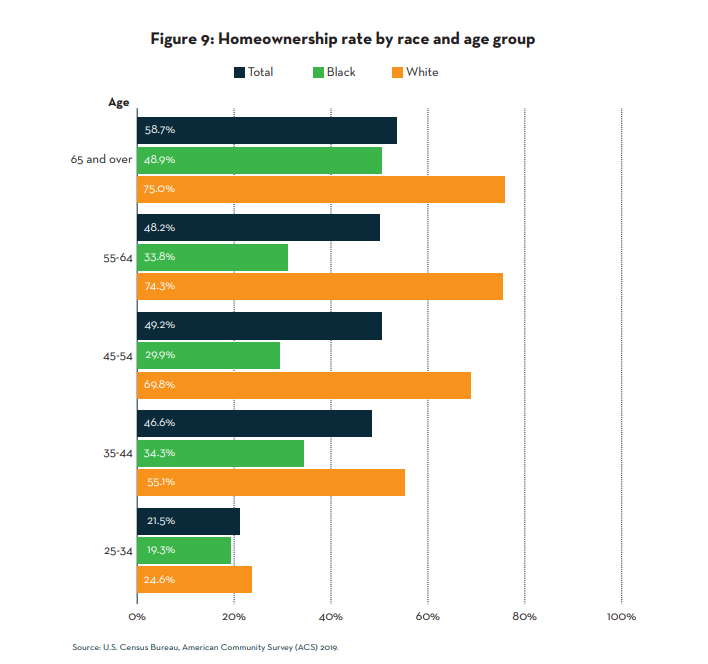

Just 34% of Black residents own their home, a 12 point drop from the 46% Black homeownership rate in 2005, according to a report from various housing experts convened by the mayor. Meanwhile, homeownership has increased for white residents over that same time period, hovering around 49%. D.C. has also seen a decline in Black residents over that time, falling to 49.2 percent by 2011 according to the D.C. Policy Center.

“The combination of redlining, racial covenants, and discrimination in lending that barred Black residents from the government-backed mortgages available to white families deprived D.C.’s remaining Black households of the economic gain homeownership can bring,” the report says. “These early policies continue to have reverberating effects.”

The average household income for white locals is three times that of Black locals, putting them further out of reach of homeownership — a vicious cycle because that’s a form of wealth building. The report by the mayor’s so-called Black Homeownership Strike Force — created earlier this year and led by Interim Director of the Office of Planning Anita Cozart and Senior Minister of Plymouth Congregational United Church of Christ Rev. Graylan Scott Hagler — identified limited financing and preparedness, as well as a lack of housing supply and risks of maintaining one’s home, as the main challenges facing Black renters who are interested in buying.

The strike force also identified various ways D.C. could increase Black homeownership, including:

- Leverage the city’s $10 million fund aimed at increasing Black homeownership by creating a public-private fund similar to the Housing Production Trust Fund and reserving some units for Black homebuyers.

- Identify ways to accelerate zoning and permitting for homeownership projects, particularly those where units are at or below 80% of the median family income.

- Pass legislation to protect homeowners against unwanted solicitation with regard to the sale or potential purchase of their homes, as well as legislation that reduces the impact of housing speculators and establishes a requirement that investors disclose more information like permits used and renovation costs to homebuyers.

- Aid experienced Black homeowners at risk of foreclosure due to their inability to pay mortgage or other housing fees.

- Consider financial incentives like tax saving and reduced fees to promote the transfers of ownership between Black homeowners and their heirs.

- Convene government agencies that provide home ownership aid to coordinate their program offerings, and have those agencies broaden the awareness of existing programs like by creating a comprehensive online platform.

- Increase effectiveness of homeownership programs like automating the Home Purchase Assistance Program application process.

The strike force decided on 20,000 new Black homeowners in part to stem the exodus of the 5,000 Black homeowners between 2010 and 2020 and on national goals set. The goal was the subject of various meetings and public engagement efforts, according to the report.

The city has a number of programs that help local homeowners like Home Purchase Assistance Program, Employer Assisted Housing Program, and DC Open Doors, which are featured on a website called Front Door aimed to help residents navigate resources. The strike force called on more investment into these programs. Bowser already announced that her administration would increase the loan available for prospective homeowners under the Home Purchase Assistance Program beginning October from $80,000 to $202,000, with an additional $4,000 in closing cost assistance.

Some housing advocates have already expressed concerns about meeting the ambitious goal. D.C. allowed foreclosures to proceed again starting last Friday, and Legal Aid Society of D.C. is concerned that some homeowners will be displaced while the D.C. government considers their application for federal funds. “We won’t be able to meet our goal of increasing the overall rate of Black homeownership without preserving current homeowners,” Shirley Horng, the senior staff attorney at the Legal Aid Society of D.C., told the Washington City Paper.

Related Coverage:

Amanda Michelle Gomez

Amanda Michelle Gomez