Via Shutterstock

Via Shutterstock

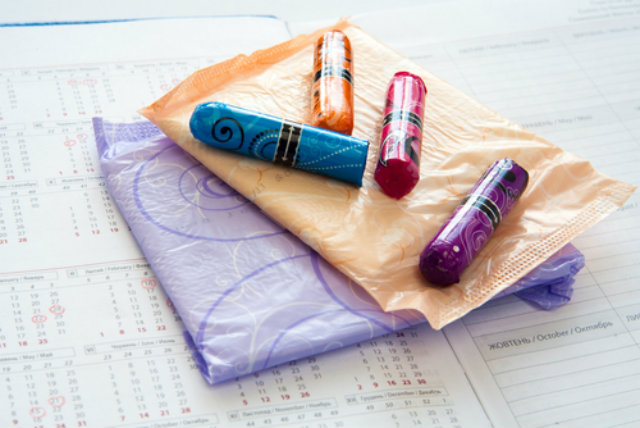

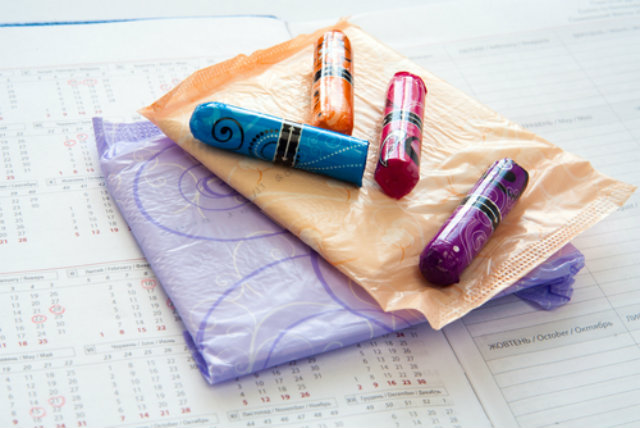

Women shouldn’t be taxed for menstruating, and parents shouldn’t be charged for their babies’ lack of bladder control, according to At-Large Councilmember Anita Bonds, who authored the “Feminine Hygiene and Diapers Sales Tax Exemption Amendment Act of 2016.” The legislation is being introduced today to eliminate the sales tax imposed on feminine hygiene products and diapers for children and adults.

In the District, prescription and nonprescription drugs that are considered necessities, such as pacemakers, wheelchairs, crutches, and artificial limbs—including, somehow Viagra—are exempt from sales tax. Grocery items, which include candy, aren’t taxed either. But tampons, which cost women about $61.11 per year, are among the items that are charged the city’s 5.75 percent sales tax.

As a push to end the “tampon tax” makes national headlines, a handful of states, including Maryland, have already eliminated taxes for feminine hygiene products. Seven states have cut taxes on diapers.

As more states jump on board, not only are legislators stepping up, but citizens as well. In New York, a group of women filed a class action lawsuit against the New York State Department of Taxation and Finance. They’re not only seeking a permanent tax exemption for feminine hygiene products, but demanding a full tax refund for all women who have purchased tampons or pads in New York over the last two years.

The dollars that women would save over the course of their roughly 40-year cycles is significant, said the plaintiff Natalie Brasington, “I have witnessed young women counting every penny.”

Councilmember Bonds agrees, “This legislation will especially help low to moderate income mothers manage these costly expenses,” she said in a statement.

Bonds will co-introduced the bill with Councilmembers Yvette Alexander, Mary Cheh, and Vincent Orange. The act will be referred to the Committee on Finance and Revenue.