Photo by Mr.TinDC

Photo by Mr.TinDC

For all the hand wringing about whether or not D.C. can keep the millennials it catches, the answer seems to be yes by at least one measure.

The District ranked second on a LendingTree analysis of the top 100 cities with the highest percentages of requests for mortgage loans by people 35 years old and younger.

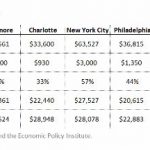

Of all LendingTree’s mortgage requests in D.C. between August 1, 2016 and February 1, 2017, 46.8 percent came from the millennials. And the average loan amount requested from these borrowers was $381,110, with an average down payment of $83,461 and monthly payment of $1,855.

The only city with a higher percentage was Pittsburgh, coming in at 48.4 percent. Des Moines, Boston, and St. Louis rounded out the top five.

Overall, about 36.1 percent of LendingTree’s mortgage loan requests were from millennials.

A Zillow ranking last year that listed where the most affluent millennials live placed D.C. at number eight—tying with New York (“super cool” Arlington placed first on that list).

Zillow’s data showed that 2.8 percent of millennial-led households in the District make $350,000 a year. That lands them in the top four percent of people in the D.C. region, according to this New York Times map.