Virginians and Marylanders often argue that one of the many things stopping them from moving into the District is the taxes. Heck, even those of us who are District residents have complained of the city’s historically high taxes. But are all those complaints just as much a myth as the idea that Washington was once a swamp? It looks like it.

By way of the Post and D.C. Metblogs, we find that the D.C. Fiscal Policy Institute yesterday released a report whose findings might shock some of us. They write:

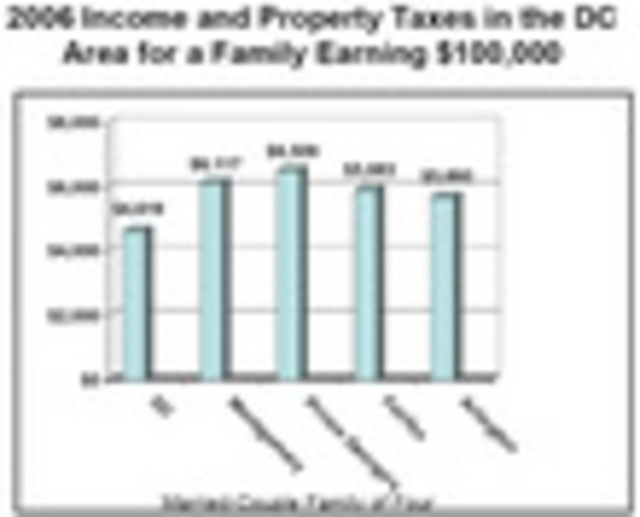

The District of Columbia has a reputation for being a high-tax jurisdiction. The conventional wisdom is that DC households pay more in taxes than their neighbors in suburban Maryland and Virginia — and that DC’s tax levels are a hindrance to its ability to retain and attract residents.

A review of area taxes, however, shows the conventional wisdom is not correct. Rather than the highest taxes in the region, taxes paid by middle-income families and individuals in the District are lower in most cases than these same families would pay if they lived in either the Maryland or Virginia suburbs. DC has now met — and in most cases exceeded — the much-discussed goal of “tax parity” with its neighboring jurisdictions, in significant part because of income and property tax cuts implemented in recent years.

Of course, their numbers assume the person or family in question makes between $50,000 and $150,000, so for those of us not there yet, the District may still be an expensive place to live. And in some regards, D.C. is still more expensive in taxes than Virginia, but less so than Maryland. Finally, there are a few caveats here and there that need to be taking into consideration, notably federal income tax deductions based on state taxes paid. But all told it’s good to know that D.C. isn’t mythical expensive, at least not in tax terms. Now if only we could get out of paying federal taxes…

Martin Austermuhle

Martin Austermuhle